¿Todas las consultas de servicio al cliente (preventa, ventas y posventa) son iguales en todas las industrias y organizaciones? En primer lugar, reconozcamos que los requisitos generales para el servicio de atención al cliente son:

- Personal con un amplio conocimiento de productos y procesos.

- Tiempo de espera (incluida la tasa de abandono y otros KPI operativos)

- Empatía (entre otras habilidades personales)

- Fuerte liderazgo de los agentes para guiar a los clientes hacia la solución deseada.

Ahora, abordemos la siguiente pregunta: ¿Son estos requisitos similares en todas las industrias?

- La respuesta inicial que viene a la mente es que diferentes productos/servicios pueden requerir diferentes niveles de entrega. Sin embargo, no se debe necesariamente a que los productos/servicios sean diferentes, sino más bien a las posibles consecuencias de no cumplir con el nivel esperado que diferencian a las empresas.

Por ejemplo, tener un problema con una dirección de entrega puede causar un retraso de 24 horas en la entrega de un libro, lo cual es frustrante para el cliente. Sin embargo, una entrada de dirección incorrecta puede tener graves consecuencias para una ambulancia de emergencia

- Otro factor es la configuración de la organización, lo que significa que las formas en que se generan y comparten los procesos, las políticas y el conocimiento del producto/servicio dependen de la organización empresarial en general.

Por ejemplo, si todas las actividades empresariales son internas y se encuentran en una única ubicación, el flujo de trabajo para el abastecimiento, la creación y el intercambio de información clave (conocimiento) será completamente diferente en comparación con una

organización con varios sitios y una combinación de operaciones de servicio internas y subcontratadas.

- El nivel de cumplimiento y las restricciones legales también pueden variar mucho según el tipo de servicio. Ciertos mercados están sujetos a estrictas normas legales y están obligados a proporcionar información dentro de un formato específico.

Por ejemplo, si vendes zapatos en línea o si estás en el negocio de préstamos bancarios, tus limitaciones y responsabilidades corporativas son de una naturaleza muy diferente

- Además, algunas industrias tienen procesos inherentemente complejos y deben realizar un seguimiento del histórico (trazabilidad). Hacer un seguimiento de las políticas pasadas y los procedimientos a largo plazo requiere gestionar una cantidad significativa de información y conocimientos con disciplina

Por ejemplo, en la industria de la electrónica de consumo, no es vital realizar un seguimiento de las especificaciones de hardware de una grabadora de CD ROM que un cliente compró hace 10 años, pero es fundamental que un banco comprenda las condiciones bajo las cuales se le otorgó a un cliente una hipoteca hace 15 años.

Ahora, repasemos qué hace que la atención al cliente de servicios financieros sea tan específica en términos de expectativas para el servicio al cliente y qué hace que las industrias financieras (bancos, proveedores de crédito, seguros, etc.) sean diferentes en la forma en que brindan información a los clientes.

En SHA, trabajamos en estrecha colaboración con nuestros clientes para garantizar que nuestra solución de gestión del conocimiento se adapte a sus niveles de calidad específicos, al tiempo que mejoramos tanto el coste de servicio como la experiencia del personal.

Entonces, ¿qué tiene de específico la gestión de información financiera? Con base en la experiencia de SHA, se destacan los siguientes puntos:

- Volumen masivo de información de diferentes fuentes y formatos de datos. Los procesos financieros a menudo incluyen documentación heredada, así como documentos editados recientemente de los departamentos legales, financieros, comerciales y de marketing.

- Procesos y procedimientos largos y complejos. Esto requiere técnicas especiales, como los flujos de decisión en árbol, para mejorar la comunicación y las interacciones con los clientes. No es factible que el personal de Atención al Cliente absorba todos los detalles de cada procedimiento.

- Procedimientos con exposición legal la mayoría de las veces. Proporcionar información inexacta puede conllevar importantes riesgos financieros y de imagen. Si el servicio de atención al cliente se subcontrata a un BPO, el contenido debe ser validado por expertos internos, ya que no se pueden delegar responsabilidades críticas.

- La experiencia del cliente se ve afectada por la “facilidad para interactuar”. Es un hecho conocido que el personal de Servicio al Cliente puede explicar las cosas mejor y más rápido cuando la información se presenta de manera amigable.

- Dificultad para entrenar y retener conocimientos por parte de los usuarios. Con la volatilidad de las especificaciones de los productos y los cambios en las políticas, es difícil mantenerse al día con los conocimientos, incluso en cuestiones básicas como los tipos de cambio o las tasas de interés.

- Abordar el 100% de las preguntas es crucial. A diferencia de otras empresas, incluso una pregunta no frecuente merece la misma atención que las 10 consultas principales. Las herramientas públicas de conocimiento de la IA no pueden considerarse lo suficientemente seguras para recuperar información crítica.

SHA-SAAS también aporta nuestra experiencia del cliente a la solución, proporcionando las siguientes áreas de oportunidades:

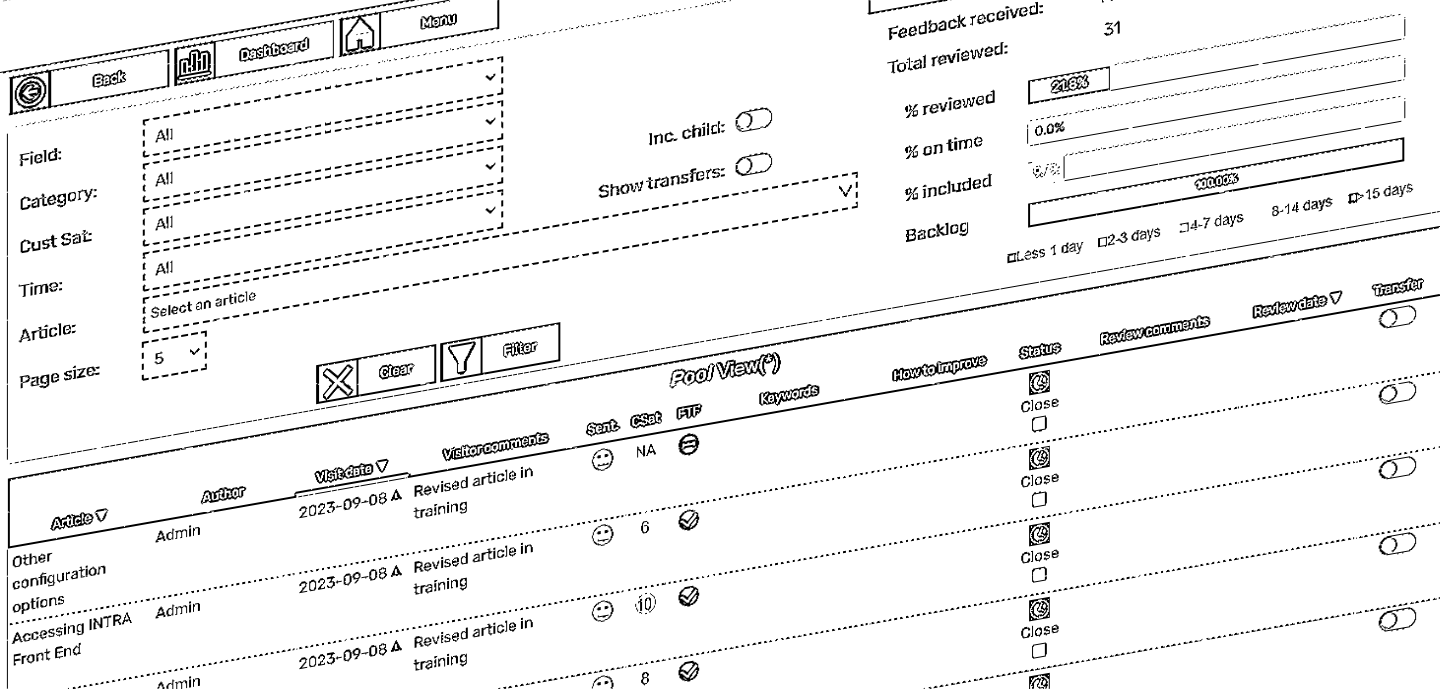

- Sistema único para controlar todos los procesos y procedimientos. Todas las entradas de legal, marketing, ventas, finanzas, etc. se consolidan en un solo sistema con una herramienta de búsqueda simple y altamente eficiente.

- Control de calidad y control de distribución. Los comentarios sobre la experiencia de los agentes y los clientes se utilizan para identificar los procesos más difíciles de entender, lo que permite a los autores reelaborarlos y mejorarlos

- Gestión del cambio. El conocimiento debe ser dinámico, y las formas de proporcionarlo requieren planes de mejora continua tanto para el propio conocimiento como para sus usuarios.

- Creación de documentación formal/aprobada/procedimientos operativos estándar. Los exhaustivos procesos de aprobación garantizan el cumplimiento de las normas de gobernanza de las instituciones financieras, adaptándose a configuraciones de operaciones simples y complejas.

- Funciones integradas de control y planificación de la formación. El conocimiento es crítico, pero el uso del conocimiento por parte del personal de Servicio al Cliente es aún más importante. Los módulos de formación avanzados, los programas de formación personalizados individuales y la supervisión del rendimiento del conocimiento individual están integrados en el Sistema de Gestión del Conocimiento.

- Análisis de “GAPS” y sugerencias de mejora. Nuestras herramientas de gestión del conocimiento basadas en IA permiten detectar desviaciones de calidad en el contenido y sugieren mejoras.

Los clientes de SHA han disfrutado de los siguientes beneficios utilizando nuestro Sistema de Gestión del Conocimiento:

- Reducción importante de papeleo. No solo eliminando el conocimiento basado en “papel”, sino también reduciendo y optimizando los flujos de proceso en una ventanilla única de conocimiento.

- Refuerzo y agilización de los procesos de homologación. Alineación de los procesos de aprobación con las Directrices de Gobierno Corporativo, proporcionando un flujo de trabajo transparente, rápido y exhaustivo para la creación de conocimientos.

- Reducción de las necesidades de formación “presencial”. Reducción de la duración de la formación para el nuevo personal y actualización de la formación, lo que conduce a una mayor productividad per cápita y una mejor sincronía con los nuevos productos y anuncios de políticas.

- Mejora en la precisión de la resolución de problemas y reducción del tiempo invertido. Una mejor información proporcionada a los equipos de servicio al cliente conduce a una mejor productividad.

- Mejora de la experiencia del cliente y del personal. El suministro de información precisa y actualizada y la orientación eficiente dan como resultado una experiencia mejorada tanto para los clientes como para el personal.

Si comparamos los logros/beneficios de SHA con los requisitos de servicio al cliente identificados mencionados anteriormente, podemos ver lo siguiente:

| Necesidades genéricas | Funcionalidades y Beneficios de SHA para gestionar el Conocimiento | Idoneidad de Atención al Cliente para el Sector Financiero y SHA |

| Personal con el máximo conocimiento de productos y procesos | La gestión del conocimiento básico con la función de formación integrada | SHAadmite información multiformato y garantiza la actualización de los datos utilizados por los equipos de servicio al cliente. Es perfecto para la gobernanza interna de la validación central con operaciones remotas de BPO. |

| Procesos orientados al cliente y políticas amigables para el cliente | La retroalimentación integrada del personal de Servicio al Cliente sobre el Sistema de Gestión del Conocimiento y el módulo de coaching SHA permiten mejoras continuas del personal. | Las explicaciones claras son esenciales para los procesos financieros complejos. |

| Tiempo de espera: | La reducción de la duración de las llamadas con información precisa y fácil de encontrar mejora la eficiencia operativa, | que es crucial para las operaciones financieras rentables. |

| Empatía (dentro de otras habilidades blandas) | El personal de servicio al cliente bien capacitado y proporcionado con información de soporte clara puede centrarse en la satisfacción del cliente y mejorar la retención y la adquisición. | La satisfacción del cliente se ha convertido en un fuerte diferenciador a medida que los clientes de servicios financieros se vuelven más volátiles con el crecimiento de las ofertas de banca y seguros en línea. |

| Fuerte liderazgo de los agentes para guiar a los clientes hacia la solución u oferta esperada: | El enfoque de la capacitación y la educación del personal cambia a la gestión del flujo de llamadas en lugar de al conocimiento puro y duro. El seguimiento de la formación individual y en equipo refuerza la calidad de las interacciones con los clientes y prospectos, lo que conduce a la reducción de costos y al crecimiento de los ingresos | la resolución a la primera para el soporte y la tasa de conversión |

En conclusión, si bien los servicios financieros requieren que se cumplan los requisitos básicos del servicio de atención al cliente, existen elementos adicionales que deben tenerse en cuenta y abordarse. El Sistema de Gestión del Conocimiento de SHA ofrece estos elementos de una manera práctica y rentable.

Y si SHA sobresale en el cumplimiento de las expectativas más exigentes, también es una gran opción para todos los demás mercados con diferentes niveles de rendimiento esperado

SHA es un sistema de gestión del conocimiento diseñado y desarrollado por expertos en servicio al cliente experimentados que han aportado su visión y experiencia operativa diaria para ofrecer un sistema que mejora la experiencia del cliente, mejora la experiencia del personal y reduce el costo del servicio.

Para más información, contáctenos en: